2023 is here and will likely begin the greatest number of deep energy retrofits ever performed on commercial buildings in the US. Yes, the new 179D is very generous, and likely to motivate many building owners to jump in. That’s why the first R-Value podcast of 2023 is diving into the tax credit, as well as this blog, which will hopefully help you, help your customers, find the money.

Before we go into the 179D, there are some funding avenues you should know about. The main challenge with tax credits, is that the customer doesn’t have that money when you start the project. Certainly, it would be great if business owners could just hand you a check for $80,000.00 straight from their cashflow, but that’s not in most of their budgets. Yet, most of them want to use less energy, make their customers more comfortable, and decrease their costs. While 179D loans and other help may be available in the future, here are 5 ways that may help them get it done now.

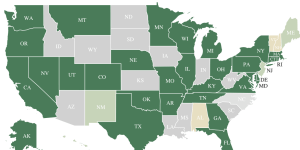

1. One of the first places to find a solution would be PACE programs. In this case, the money is tied to the property. PACE is Property Assessed Clean Energy. The program is designed to get building energy upgrades done and simply add the project cost to the property taxes, where they can be spread out over 20 years or so. Pace allows owners to fund projects with no money up front. Basically, the cost of the project is paid through a lien on the property and assessed with the property tax payment. The map at PaceNation.org shows 38 states as having active PACE legislation. In fact, California, Florida, & Missouri, even offer PACE funding on residential projects. If you would like more resources or to help your customers get into a PACE program visit www.PACENation.US

This next one (Community Solar) needs to be prefaced with the fact that fixing the building envelope can reduce solar costs. Being an authority in rebates and knowing how to help your customer reach their goals can be very lucrative. If you find a community solar program in your area, getting to know the program manager, may get you a chance to pitch fixing the building envelopes for every building in the program.

2. Community Solar. Installation of solar and solar capacity will likely double in the next five years. Did you know that there is one, or more, community solar projects in 41 states and Washington DC? Did you know that many more are planned? Community solar creates an option for businesses who don’t have enough roof, sunlight, or funding, to group together. For their portion of a solar array, they receive credits offsetting their electricity bill. For more information on Community Solar, click here.

3. www.DSIREUSA.org – This is the Database of State Incentives for Renewable Energy. Bookmark this website. Simply put in the zip code for any area you cover and up pops all the rebate programs being offered in that area. Boom… As an example, I typed in the zip for Arlington, TX and found 47 programs, then in Denver, I found 61. And while most of the programs will not apply to you, some will. The best thing to do is check the site every 3-6 months for new ones that come up. In fact, anytime you go to another county or where there is another utility provider, be sure to check in that area. These programs are often used to lower grid demand in areas where needed.

4. Local Utility Providers – Every day more utilities are funding projects that improve buildings and decrease demand. I know when I looked locally, not only were there rebates and case studies from major projects, but my local provider was actively looking for contractors to send work to.

5. 179D – So the first place to get information on the 179D is this month’s R-Value Podcast, where we interview Bill Harbeson from Cherry Bekaert. Considering the 179D credit can be up to $5.00/ square foot, there are strings attached. For a project to qualify, upgrades and improvements to the building must result in total annual energy and power costs that are reduced by at least 50 percent, in comparison to a Reference Building which meets the minimum requirements of ASHRAE Standard 90.1. In addition to that, the reduction must be verified by a third-party using computer modeling software.

The 179D is a tax issue (think accountants), that requires engineers and software to determine if a threshold has been met. Consequently, the 179D has spawned its own category of accounting firms, with engineers on staff to assist with all documentations and verifications. Traditionally the fee for their help with this has been 10% of the rebate. This is why IDI went on a search to find a national firm that could help. Most of the ones we spoke with only wanted to pursue buildings 50,000 square feet or larger, to make it worth their while. This is where CBH comes in.

Bill and his team at CBH help contractors on buildings of all sizes, even down to 5000 square feet. Everyone we spoke with was extremely helpful. Bill said that anyone doing a substantial upgrade or deep energy retrofit to a commercial building could give him a call before you start, and he can estimate if the proposed scope of work will meet the bar before you begin the project. As a side note, the 179D credit can be applied to any commercial shop or building that is owned by a business. It can also be applied to multi-family buildings 4 stories and higher.

For more information on the 179D, the Inflation Reduction Act, or any of the products we carry, reach out to your local branch or any of us at IDI, where we look forward to earning your business every day.