Understanding the Inflation Reduction Act Energy Tax Credits and Rebates

The Inflation Reduction Act (IRA) passed in August 2022 will provide tax credits and rebates for home energy efficiency improvements. This guide will help you and your clients navigate how to cash in on the incentives.

Need a Refresher About the IRA?What is the Inflation Reduction Act & How Does it Work?

Passed in August 2022, the Inflation Reduction Act (IRA) will work to lower the cost of living for American Families. For those home and business owners who want to improve the energy efficiency of their building, the Inflation Reduction Act provides tax credits and rebates to offset the cost. While they will need to pay for the cost upfront, the credits and rebates, and lifetime energy savings can help families to make healthier, cost-effective choices.

As insulation installers, you can help clients in choosing to improve their building envelope and provide the service of navigating how to benefit from IRA incentives.

Credits

A tax credit means you claim them on your federal taxes when you go to file. The amount of credit is then applied to what taxes are owed and/or what you can expect to receive back.

The following IRA sections are tax credits:

- 45L: Multi-family property owners will receive $2,500.00 credit for homes that meet Energy Star ratings, or $5,000.00 credit if they meet Zero Energy Ready Home (ZERH) requirements from 2023 through 2032.

- 179D: Commercial property owners will receive between $1.88 and $5.00 a square foot for new construction or existing building retrofits that meet energy efficiency requirements.

- 25C: They can receive up to 30% (up to $1,200.00 of the cost of the products for a project) to retrofit residential buildings. There isn’t a cap on the number of services they can do through 2032, so they can get tax credits for each service they do each year until then.

Rebates

Unlike federal tax credits, the Inflation Reduction Act energy rebates will be issued through participating states. Clients should research their state’s rebate offers and how to apply; for many Americans, the property owner will put the money down up-front and receive an allotted amount back from the state. The method of sending in rebates, again, will depend on the state.

The following IRA sections are rebates:

- HOMES (Home Owner Managing Energy Savings) Rebate Program: A contractor will do an energy assessment of the home, design a retrofit package, and model the savings. Incentives for most households are $2,000 for 20% energy savings and $4,000 for 35% energy savings, but these are doubled for households with income below 80% of the area median income (AMI)

- High-Efficiency Electric Home Rebate Program: Includes up to $14,000 per household for insulation, air sealing, and ventilation.

- Weatherization Assistance Program: Funding per house or multi-family property is typically capped at an average of about $8,000.

Need Help Navigating Credits and Rebates?

We know understanding all the differences between the Inflation Reduction Act energy credits and rebates — and what your customers qualify for — is difficult. Our team has researched the IRA and is available for any questions you may have.

Contact Us With Your Questions Call Your Local IDIStay Competitive with IDI’s Classes & Training

Because the Inflation Reduction Act bill requires extensive knowledge and reporting on the ways in which a project positively impacts the energy performance of a building, it’s important that your insulation team is prepared with the latest best practices to help clients receive the credits and rebates they deserve. Whether your team has years of experience or is new to the insulation business, IDI’s classes and training will help you stay ahead of the competition while providing a valuable service to your employees.

IDI’s comprehensive training classes cover the complete insulation process, wholesale fiberglass insulation, building science and codes, health and safety training, and everything else you need to increase your productivity and profits.

Get help navigating the IRA guidelines and ensure your team is prepared to aid new clients with IDI’s classes and training.

State Impact on the IRA

While existing and reinstated energy programs will provide federal tax credits, to fully benefit from the Inflation Reduction Act bill, states need to individually opt-in to the program and provide rebates. New programs will be implemented in mid- to late-2023 depending on your state.

If you need help navigating your state’s IRA rebates, our local offices stay up to date on the latest information. Contact your local sales rep to learn more.

The Industry’s Insulation Expert

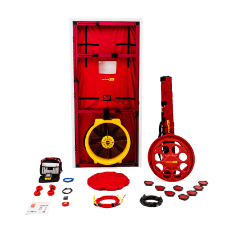

Since 1979, IDI has provided insulation contractors with a wide selection of quality supplies and equipment. As a family-owned and operated company with locations around the country, we have helped over 3,000 independent insulation contractors and distributors successfully profit and grow their own businesses nationwide.

When you need more than an insulation distributor, call IDI. We provide resources, services, support, products, and professionalism that help you succeed.